Haldimand County Council Approves 2020 Tax-Supported Operating Budget

On April 21, 2020, Haldimand County Council met virtually to review and approve the 2020 Tax Supported Operating Budget. The budget results in a total levy requirement of $69,823,910, which equates to a residential tax impact of about 0.93%, or about $2.50 per month for an average residential property owner.

“The 2020 Tax-Supported Operating Budget represents a financially sustainable, responsive plan that ensures the continued delivery of essential services our communities value,” said Mayor Ken Hewitt. “When we announced the property tax payment grace period on March 19, we also directed staff to scrutinize and evaluate this budget extra carefully in light of the COVID-19 situation. All aspects of the budget have been carefully evaluated case by case to ensure they contribute to our corporate priorities, especially given the current economic climate,” he continued.

Generally, the annual Tax Supported Operating Budget pays for day to day operations of the County, including salaries, wages, utilities, insurance and services such as running arenas/programming, keeping the roads safe, maintaining locals parks and cemeteries, providing emergency services (fire, police and ambulance), collection of garbage and recyclables & related activities.

The 2020 Tax-Supported Operating Budget highlights several investments in service delivery and community vibrancy, including enhanced support/resources for community partnership projects, facilities/parks maintenance and technology-related services that improve customer experience.

Additionally, the budget outlines the creation of a new Climate Change and Emergency Response Provisions fund to address the financial impacts of these events (e.g: flooding, pandemics) and ensure the County is prepared to respond.

“By taking a strategic, long-range financial planning approach, the County is well-positioned to deliver high-quality, affordable services now and in the future,” added Hewitt.

Haldimand’s Chief Administrative Officer Craig Manley notes that the budget was developed to meet community needs while minimizing the overall impact on taxpayers. “While there are some new initiatives and budget lines introduced to meet increased or emergent needs, we’ve been able to offset those costs by holding the line on other items.”

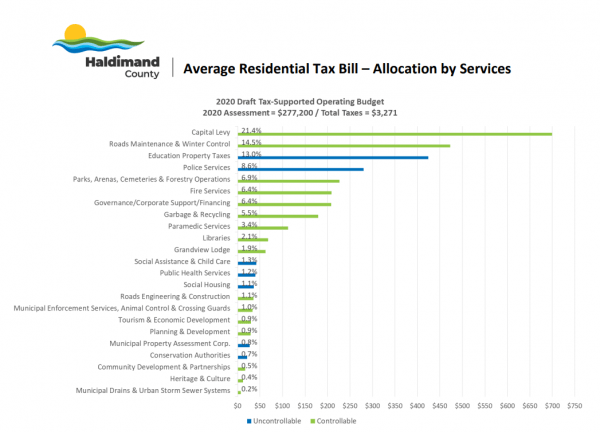

On average, a residential property owner can expect their annual property taxes to be allocated as follows:

More information on County budgets and budget processes is available on the County website via HaldimandCounty.ca/financials/budgets.