Haldimand County Council Approves 2021 Tax-Supported Operating Budget

On March 31, 2021, Haldimand County Council reviewed and approved the 2021 Tax Supported Operating Budget. The budget results in a total levy requirement of $72,553,300, which equates to a residential tax impact of about 1.96%, or about $5.35 per month for an average residential property owner with an assessed value of approximately $279,000.

Generally, the annual Tax Supported Operating Budget pays for day to day operations of the County, including salaries, wages, utilities, insurance and services such as running arenas/programming, maintaining locals parks and cemeteries, providing emergency services (fire, police and ambulance), the collection of garbage and related activities.

“The 2021 Tax-Supported Operating Budget represents a financially sustainable, responsive plan that ensures the continued delivery of essential services our communities value,” said Haldimand County Chief Administrative Officer Craig Manley. “Despite significant financial challenges related to COVID-19 and other unforeseen circumstances, staff have developed an operating budget that comes in below Council’s targeted tax rate increase of 2% or less,” Manley added.

Manley noted that Provincial funding received to date combined with significant cost-containment measures undertaken in 2020 (e.g. limiting hiring and effectuating mandatory leaves for some staff during Provincial lockdowns) have helped alleviate the tax burden.

The 2021 Tax-Supported Operating Budget highlights several investments in municipal service delivery, including:

- organizational and staffing initiatives to enhance customer service and communications

- proceeding with internal, technology-focused projects that will improve access to public-facing services, increase efficiencies and strengthen cybersecurity

- hiring additional building & by-law staff to facilitate enforcement and ensure the continuation of timely permit approvals

- hiring additional staff to address growth-related needs associated with winter control and environmental operations

- providing temporary project management resources to expedite major Corporate priority initiatives (e.g. Broadband Internet Project, Caledonia Fire Hall, Norfolk County/Six Nations water supply initiative).

“This was an extremely difficult budget to develop under ever-changing pressures and circumstances. Staff have worked hard to bring forward a reasonable, fiscally responsible budget that addresses community needs and upholds the levels of service our residents have come to expect,” noted Haldimand County Mayor Ken Hewitt.

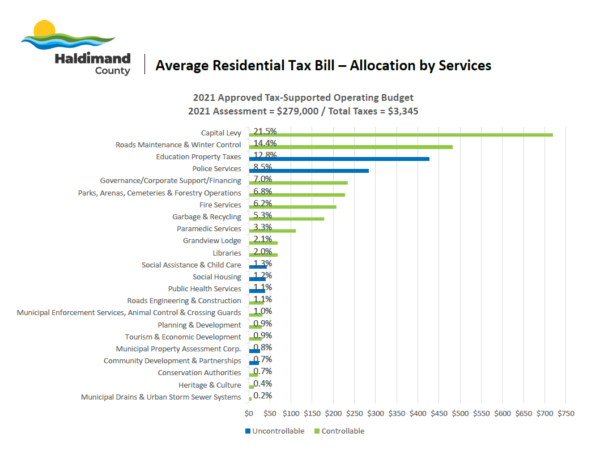

On average, a residential property owner can expect their annual property taxes to be allocated as follows:

More information on County budgets and budget processes is available on the County website via HaldimandCounty.ca/financials/budgets.